To Outsource or Not to Outsource in 2025

A practical, data-driven guide for AI-first startups and scale-ups on making the single most capital-intensive choice before product/market fit: building in-house AI teams versus tapping external talent for maximum speed-to-market per dollar.

To Outsource or Not to Outsource in 2025

A practical, data-driven guide for AI-first startups and scale-ups

In 2025 the decision to build an in-house AI team or tap external talent is no longer a theoretical MBA exercise. It is the single most capital-intensive choice most founders make before product/market fit. Drawing on fresh salary data, live outsourcing rates, and real-world ROI numbers, this guide shows why an “either-or” framing often obscures the real optimisation problem: maximising speed-to-market per dollar while safeguarding IP and future scale.

Contents

- Executive Takeaways

- Market Context: 2025 Talent & Cost Landscape

- The ROI Lens: Measuring What Matters

- Four Strategic Hiring Scenarios Re-visited

- Beyond Cost: Hidden Friction & Opportunity Costs

- Decision Framework & Checklist

- Conclusion

Executive Takeaways

1. Time has out-priced talent. A US mid-level AI engineer now costs roughly $192k in Year 1 when benefits, office, and onboarding are included, versus ~$63k via a high-quality offshore partner—a 67% deltamailamengg.com theddcgroup.com artech.com.

2. Productivity gaps remain wide. Senior GenAI talent in the US commands 10× Indian in-house salaries, yet ships only 2–3× faster on typical inference-heavy workloads, making offshore senior engineers (EU or India) the sweet spot for cost-per-unit-outputsuavesol.net 6figr.com upplabs.com.

3. ROI hinges on deployment speed. Projects that hit production 3-4 months earlier return 200 – 450% in Year 1, dwarfing marginal salary savingsilo.org designrush.com upgrad.com.

4. Hybrid is the new default. Winning teams keep a staff “spine” (CTO + product AI lead) and flex around it with specialised pods from trusted vendors, avoiding permanent overhead while retaining architectural controlyatesltd.com pwc.com vlinkinfo.com.

1. Market Context: 2025 Talent & Cost Landscape

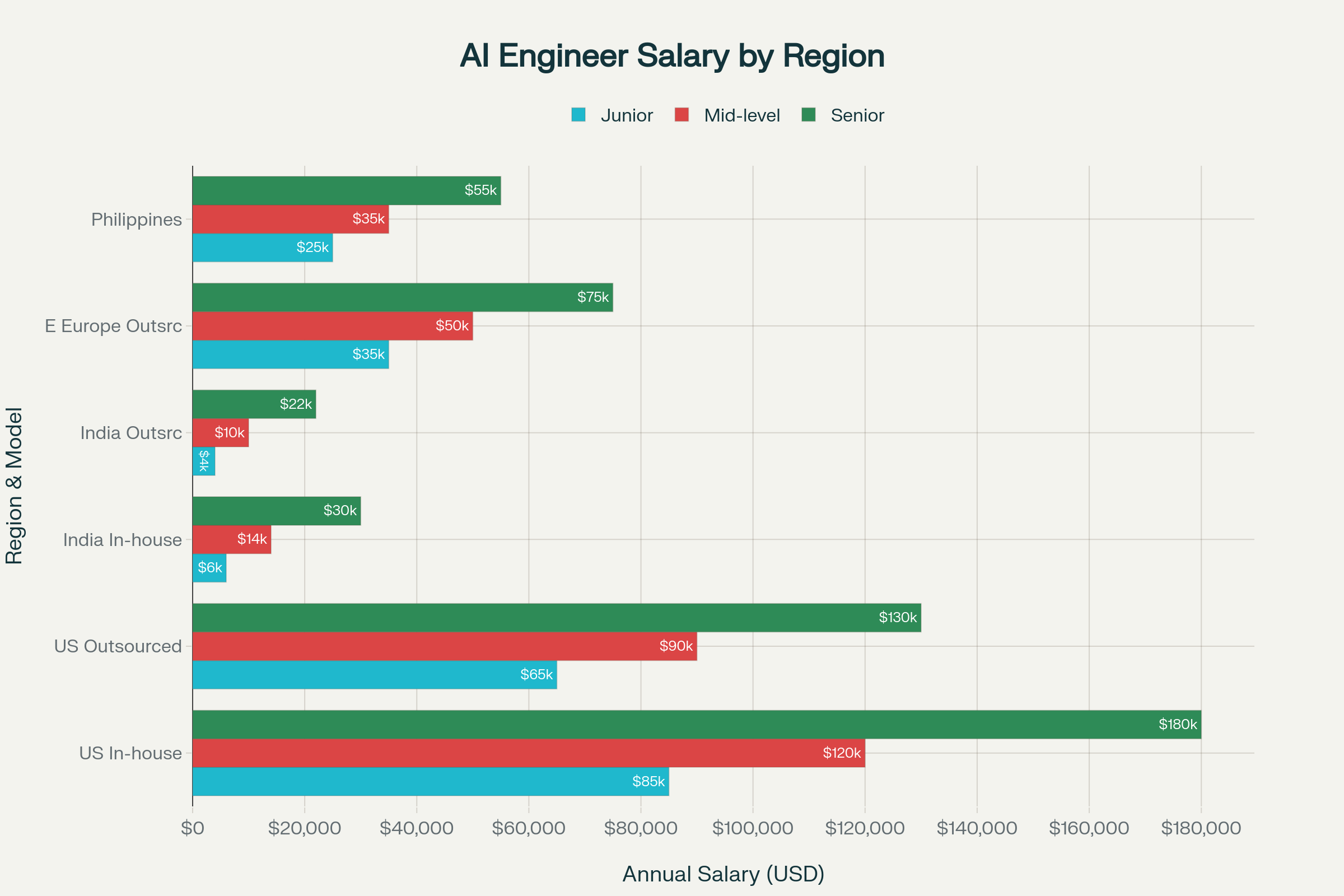

Global AI hiring is up 67% YoY while overall tech postings fell 11%glassdoor.co.in ardem.com. Salary inflation diverges sharply by region:

AI Engineer Salary Comparison Across Regions and Hiring Models (2025)

Key observations:

- US talent premium persists (2–3× Eastern EU, 5–6× India).

- Outsourced US rates dropped 10% as vendors adopt GenAI tooling gainsyatesltd.com.

- India's senior bracket (<$30k) still undercuts US entry level by 65%suavesol.net upplabs.com.

2. The ROI Lens: Measuring What Matters

Traditional “total dollars saved” is misleading. Founders should track:

- Total Annual Benefit = Cost saved + Revenue lifted.

- Payback Period (months) – cash-flow risk proxy.

- Time-to-Impact – months from idea to first production metric shift.

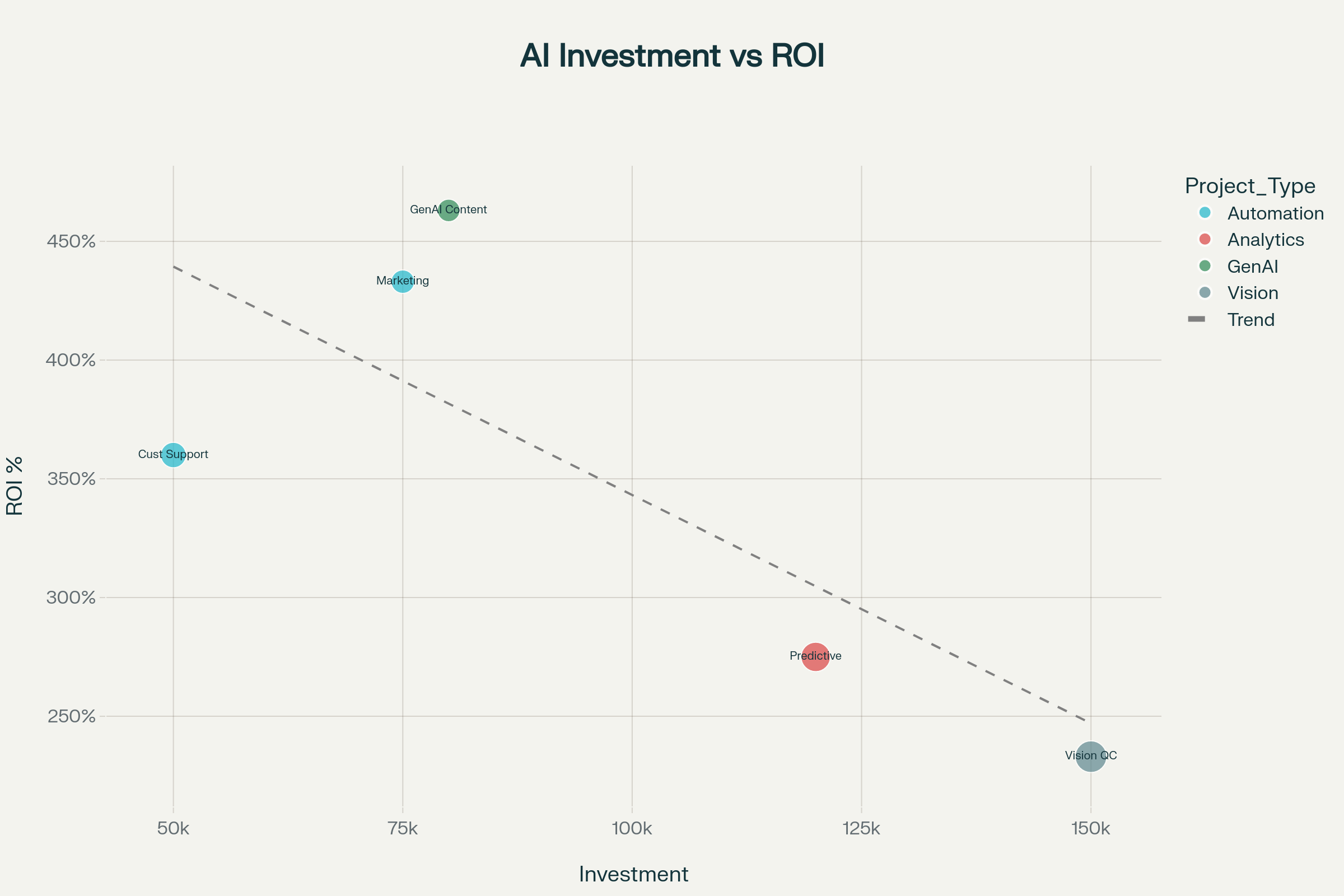

AI Project ROI vs Investment Analysis - Payback Period Comparison (2025)

Projects with sub-$100k budgets can clear 400% ROI in Year 1 if shipped inside one quarter; delays beyond six months erode ROI below 250% even on larger bets.

3. Four Strategic Scenarios Re-visited

| Scenario (2025 costs) | Optimal Talent Mix | Rationale |

|---|---|---|

| High-income HQ, high-complexity project | Offshore agency of senior GenAI + in-house architect | 60–70% cost shave; earliest delivery window; IP within internal repoyatesltd.com analytixlabs.co.in |

| High-income HQ, low-complexity prototype | Freelance or agency junior–mid offshore | Commodity models; ROI dies if payroll drags past 3 mosprismetric.com |

| Low-income HQ, high-complexity moonshot | Local senior core + select offshore specialists | Local cost base already low; communication throughput keycoursera.org kimonservices.com |

| Low-income HQ, routine features | Full in-house juniors | Payroll already minimal; context retention > vendor marginnewindianexpress.com |

4. Beyond Cost: Hidden Friction & Opportunity Costs

- Hiring Lead-Time – median 3–4 months for senior AI devs in US; vendors start in 2 weeksmillipixels.com cutshort.io.

- Technical Debt Risk – poorly-specified outsourcing inflates downstream refactor spend; mitigate with SLAs on code quality & extensibilityellow.io rocketdevs.com.

- Compliance & IP – GDPR, US export controls, sector regs; choose vendors with prior domain certifications and airtight assignment clausesrubixe.com necodex.com.

- Cultural/Time-zone Lag – each 4-hour overlap drop adds ~7% cycle time according to McKinsey DevOps benchmarks; near-shore or split-shift teams offset thisyatesltd.com deepsense.ai.

5. Decision Framework & Checklist

Step 1 – Quantify Benefit

- Map feature to direct $$ or proxy KPI (churn ↓, CSAT ↑).

- Use pilot baselines to estimate upsideilo.org producthunt.com.

Step 2 – Price Real Options

- Compute three-year TCO for in-house vs vendor (salary escalators, infra, tooling).

- Apply 15% annual learning dividend for stable in-house teams; 5% vendor efficiency gain via GenAI each yearanalytixlabs.co.in tuvsud.com.

Step 3 – Score on 5 Axes (0-10) Speed-to-launch, Cost, IP Safety, Flexibility, Talent Depth. Weight by business model (e.g., fintech weights compliance 2×).

Step 4 – Mitigate Downsides

- Dual-track code reviews by retained architect.

- Equity-linked milestone bonuses to vendors for alignmentpwc.com.

- Contractual escrow for core model weights if vendor exits.

6. Implementation Cheat-Sheet

| Task | In-house Tip | Outsourcing Tip |

|---|---|---|

| Sourcing | Use LinkedIn "AI skills" filter + coding challenge within 72 hmillipixels.com | Run 1-week paid PoC to test vendor quality & commsrubixe.com |

| Onboarding | Pair with senior for 2-week shadow sprint | Demand vendor side KT doc + daily loom updates |

| Tooling | Give Copilot/Cursor licences – 20% velocity bump | Ensure vendor IDEs comply with org SecOps baseline |

| IP / Data | Internal repo gate + feature flags | Use compartmentalised access; share only synthetic sets |

| KPI Tracking | Automate ROI dashboard (cost burn vs impact KPI) | Vendor invoices gated on KPI delta not hours |

Conclusion

Outsourcing is no longer a binary budget lever—it is a modular extension of your engineering muscle. The startups winning in 2025 keep a lean core, plug specialised pods on demand, and measure everything in months to validated KPI shift per dollar. Use the salary and ROI benchmarks above to design that hybrid, high-leverage model—and redeploy the capital you save into shipping features before the next funding crunch hits.